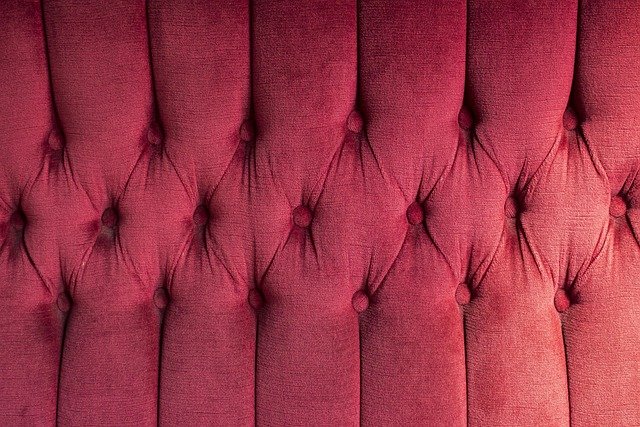

Pay Monthly Sofas

Furnishing your home just got easier with pay monthly sofas that fit your budget, even if your credit isn’t perfect. Options like bad credit no deposit sofas finance and sofas on finance no credit check make it possible to get the comfort you need without upfront costs. Whether you're looking for pay monthly sofas no credit check no deposit or sofas finance for very poor credit score, there are flexible solutions available.

What are pay monthly sofas?

Pay monthly sofas are furniture financing arrangements that allow customers to spread the cost of their purchase over an extended period. Instead of paying the full amount upfront, buyers make regular monthly payments, making it easier to afford high-quality sofas and couches. This option is particularly appealing for those who want to furnish their homes without depleting their savings or waiting to save up.

How do bad credit no deposit sofas finance work?

Bad credit no deposit sofas finance is designed for individuals with poor credit scores who may not qualify for traditional financing. These programs typically don’t require a credit check or an initial deposit, making them accessible to a wider range of consumers. Lenders offering these options often focus on factors like employment stability and income rather than credit history when determining eligibility[1].

What are the benefits of sofas on finance no credit check?

Sofas on finance with no credit check provide several advantages for consumers. Firstly, they offer a path to ownership for those who might otherwise be denied financing. Secondly, the application process is often quicker and less intrusive, as there’s no need to wait for credit checks. Lastly, making regular payments on time can potentially help improve your credit score over time, although this isn’t guaranteed[1].

Are no deposit sofas finance options widely available?

No deposit sofas finance options are becoming increasingly common in the furniture market. Many retailers and online stores now offer these programs to attract customers and increase sales. However, it’s important to note that while no upfront deposit is required, these plans may come with higher interest rates or longer repayment terms compared to traditional financing options.

What should you consider when looking for sofas finance for very poor credit score?

When seeking sofas finance with a very poor credit score, it’s crucial to carefully review the terms and conditions of any agreement. Pay attention to the interest rate, total cost of the sofa over the entire payment period, and any fees associated with late or missed payments. It’s also wise to consider your budget and ensure that the monthly payments are affordable within your current financial situation.

Comparing pay monthly sofa options: A buyer’s guide

When considering pay monthly sofas, it’s important to compare different providers and their offerings. Here’s a comparison of some popular options available in the United States:

| Provider | Financing Type | Credit Check Required | Deposit Required | Repayment Term |

|---|---|---|---|---|

| Wayfair | Affirm Financing | Yes (Soft Pull) | No | 3, 6, or 12 months |

| Ashley Furniture | In-House Financing | Yes | Varies | Up to 72 months |

| Rooms To Go | Synchrony HOME Credit Card | Yes | No | 6 to 60 months |

| Bob’s Discount Furniture | Progressive Leasing | No | First payment as deposit | 12 months |

| Rent-A-Center | Lease-to-Own | No | No | Flexible |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

While pay monthly sofas can provide an accessible path to furnishing your home, it’s crucial to approach these financing options responsibly. Always read the fine print, understand the total cost of your purchase, and ensure that the payments fit comfortably within your budget. By doing so, you can enjoy the comfort of a new sofa without compromising your financial well-being.

The shared information of this article is up-to-date as of the publishing date. For more up-to-date information, please conduct your own research.

Sources: 1. https://www.ftc.gov